China Minsheng Bank

Building a bank-wide 'Wangxiang' knowledge graph system based on the Galaxybase graph database.

Galaxybase not only accommodates correlation analysis of massive data but also offers transaction-oriented feature computation capabilities. It also supports various graph algorithm explorations

Senior Architect at China Minsheng Bank - Zhou Li

Customer Profile

Minsheng Bank is mainland China's first nationwide joint-stock commercial bank primarily initiated by private enterprises. In 2021, Minsheng Bank ranked 26th in 'The Banker' magazine's 'Top 1000 World Banks.'

Background of cooperation

In line with its digital transformation strategic goals, Minsheng Bank took the lead in enhancing its correlation analysis and application capabilities by building foundational graph capabilities and a unified knowledge graph platform. Since 2019, Minsheng Bank has been introducing distributed graph databases to establish graph storage and computation capabilities for large-scale datasets.

After market research and referencing standards such as 'Graph Database Whitepaper' and 'Graph Database Benchmark Capability Testing,' considering factors like basic operational capabilities of graph databases, graph model management capabilities, distributed capabilities, and permission management capabilities, Minsheng Bank ultimately chose to introduce Galaxybase, a self-controllable distributed graph database.

solution

The Galaxybase graph platform serves as the underlying core technology foundation for the 'Wangxiang' knowledge graph platform, providing high availability, high throughput, low latency data capabilities. It empowers the platform with end-to-end application capabilities for knowledge graph modeling, analysis, exploration, and knowledge services.

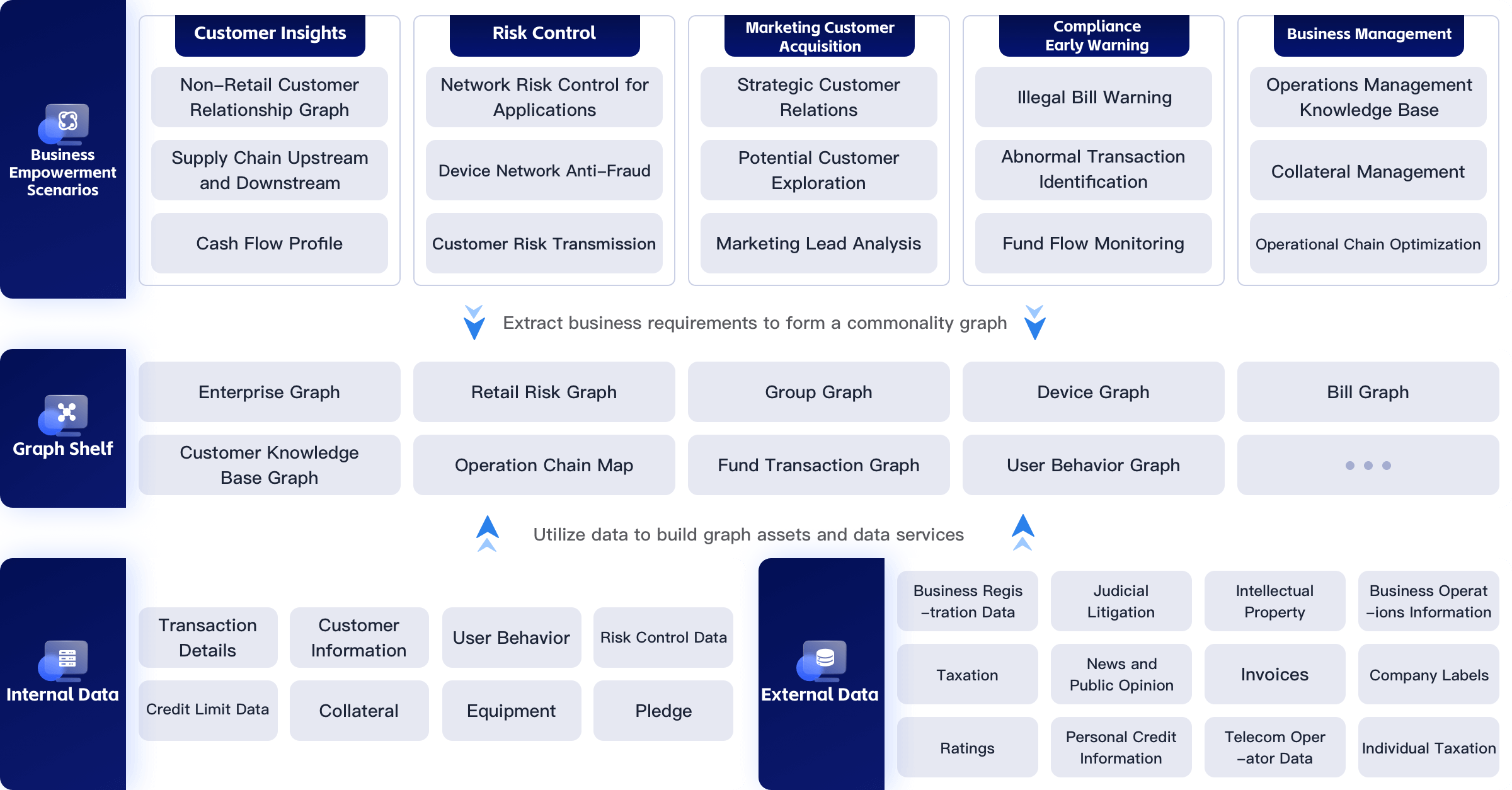

'Wangxiang' Knowledge Graph Platform Application Architecture Diagram

Application Scenarios

The 'Wangxiang' knowledge graph platform integrates data sources such as industry and commerce, judiciary, taxation, public opinion, etc., along with in-house transaction, customer, risk, guarantee, application, equipment data, forming multiple graph assets including enterprise graphs, credit risk graphs, group graphs, fund transaction graphs, etc. This empowers over 20 business areas such as customer insights, risk prevention, marketing acquisition, compliance warnings, business management, and more.

Customer Benefits

Innovative construction of a '1+N' knowledge graph system, bridging data silos

By establishing a bank-wide unified knowledge graph application platform, nearly billions of internal and external data have been interconnected to create comprehensive enterprise graphs. This enables centralized management of scenario graphs for various business lines and knowledge reuse

Targeting new pain points in business risk control, building a multi-dimensional defense line

In risk control scenarios, leveraging the associated graphs to achieve a clear view of enterprise customers, efficiently identifying individual relationship risks, group fraud risks, enhancing automated risk identification capabilities, and improving risk analysis efficiency for business personnel. Additionally, constructing transaction graphs ensures end-to-end security compliance for fund transactions, with risk response times reaching milliseconds, enabling real-time multidimensional risk control and reducing asset losses

Empowering marketing recommendations, exploring the potential value of key customer groups

In marketing scenarios, leveraging customer relationship networks for mining potential customers, enhancing fund collection and return capabilities. Statistically, the success rate of marketing to these customer segments is over six times higher than unrelated customers

Create Link is the first domestic commercial graph database supplier with fully independent intellectual property rights, dedicated to providing world-class graph database products and graph intelligence services.

Business Consulting

400-882-6897

Pre-sales Consulting

0571-88013575

Enterprise Email

partner@chuanglintech.com

Media Cooperation

Marketing@chuanglintech.com

Address

Room 605, Building 6, No.666, Zhenhua Road, Sandun Town, Xihu District, Hangzhou, Zhejiang, China