Shanghai Rural Commercial Bank

Reconstructing and upgrading the corporate credit business system based on the Galaxybase graph product

Customer Profile

Shanghai Rural Commercial Bank, established in 2005, is a joint-stock commercial bank officially approved by the China Banking Regulatory Commission. By the end of 2022, the balance of inclusive small and micro loans at Shanghai Rural Commercial Bank exceeded 64 billion yuan, with an increase of nearly 36 billion yuan over the past three years, representing a growth rate of 129%.

Business background

In the digital era, corporate credit business has become a new growth driver for banks. Banks of all sizes place high importance on corporate credit operations. Achieving precise credit risk management and exploring existing customer bases have become crucial for competition. The utilization of graph storage and graph computing capabilities within large-scale datasets is imperative.

Shanghai Rural Commercial Bank's existing Corporate Credit Management System (CMIS - Credit Management Information System) faces challenges in aligning with stringent regulatory requirements and detailed content management standards in terms of business scope, data quality management, and system performance. Upgrading the Corporate Credit Management Information System is necessary to better support business development.

Business Challenges

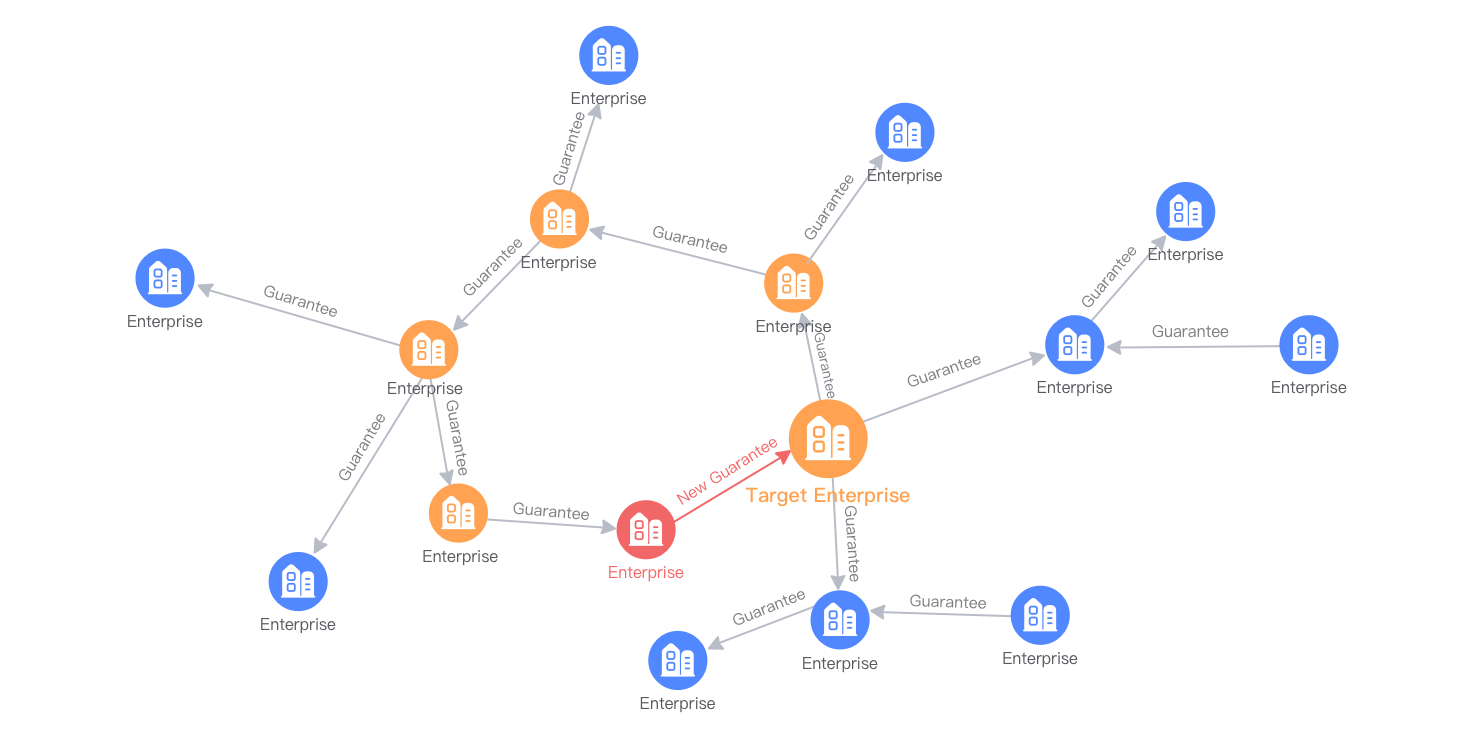

Complex 'suspected relationships' among enterprises lead to multiple risks

The information on inclusive finance customer groups is limited, making it challenging to identify and potentially overlook hidden connections within enterprises during relationship investigations. This process is time-consuming for customer managers. Moreover, non-operational risks propagated by enterprise affiliates and the overall risks associated with relationship networks are difficult to detect.

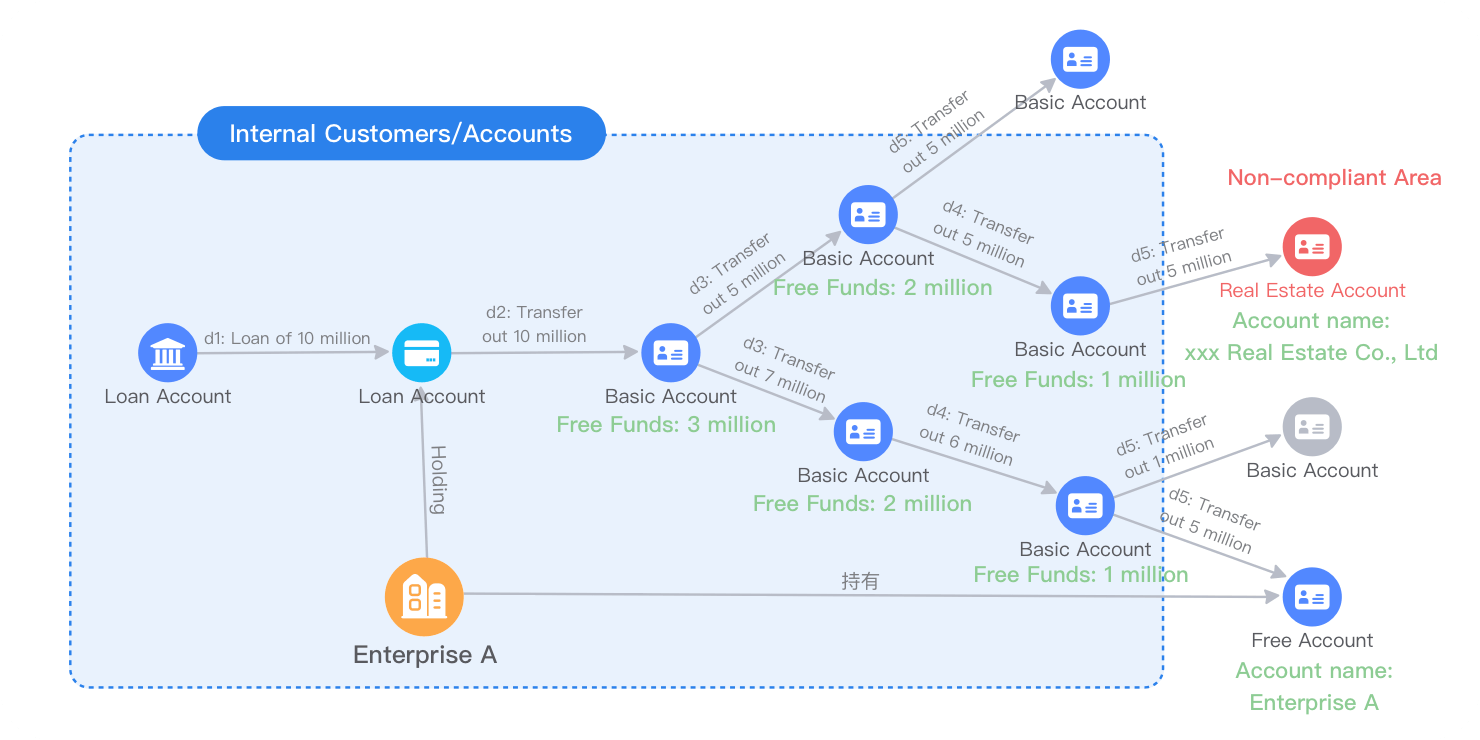

Unknown fund flows create difficulties in post-loan management

The intricate nature of loan fund transfer paths makes effective tracking challenging, hindering post-loan management. Banks lack comprehensive risk control capabilities covering the entire process from pre-loan to post-loan stages.

solution

Shanghai Rural Commercial Bank has procured the Galaxybase graph platform from Chuanglindian Technology to establish an Enterprise Relationship Graph Analysis Platform. This initiative integrates corporate credit operations with graph technology, facilitating the reconstruction and upgrade of the Corporate Credit Management System.

Graph Construction

Utilizing the Galaxybase graph database product, Shanghai Rural Commercial Bank integrates internal customer relationship data, transaction records, account opening information, credit application data, as well as external business registration data, credit bureau data, judicial litigation information, and other relevant details. This integrated and processed data is used to construct a comprehensive customer relationship graph.

Association Mining

Utilizing graph pattern matching and graph algorithm analysis, Shanghai Rural Commercial Bank establishes fundamental capabilities such as identifying relationship associations, group relationships, guarantee circles, transaction circles, and identifying closely related transaction entities. It supports business units in freely adding model rules, thereby continuously expanding the scope of risk pattern identification.

Business Empowerment

Through the upper-layer visualization platform of the Galaxybase graph platform, business personnel across departments can directly utilize the underlying computational results for decision-making, enabling intelligent marketing and end-to-end risk control.

Application Scenarios

Guarantee Circle Identification

By combining expert rules indicators such as guarantee type, amount, credit limit, and utilizing graph algorithms, Shanghai Rural Commercial Bank identifies various types of guarantee circles within networks. This process aids in detecting chain guarantees, mutual guarantees, and pinpointing core guarantor companies and bridging entities within the network.

Identification of Illicit Fund Flows

By meticulously tracing the paths of loan fund transfers, Shanghai Rural Commercial Bank distinguishes between customers' own funds and loaned funds. This process helps identify whether enterprises within transaction chains are inevitably diverting loaned funds and determines the real destination of loaned funds after multiple transfers.

Business Value

Strengthening internal and external data asset management, enhancing credit approval efficiency

By breaking down data silos between internal and external systems, Shanghai Rural Commercial Bank can swiftly disclose and visually display various customer relationships, detecting hidden connections to assist in credit approvals. This shift from manual to hybrid human-machine decision-making and data-driven decisions aids in precise credit approvals for upstream and downstream enterprises, reducing workload pressures on approval personnel significantly. This efficiency boost enhances the bank's credit review process, meeting market and customer demands for efficiency.

Establishing end-to-end credit management capabilities, real-time monitoring of associated risks

Leveraging a unified credit risk view for customers, the Galaxybase graph database automates the analysis of high-frequency real-time dynamic data, enabling real-time monitoring of customer-related risks and network risks. This broadens the business system's risk observation perspective and enhances regulatory oversight by closely tracking the actual flow of loaned funds, facilitating post-loan monitoring.

Create Link is the first domestic commercial graph database supplier with fully independent intellectual property rights, dedicated to providing world-class graph database products and graph intelligence services.

Business Consulting

400-882-6897

Pre-sales Consulting

0571-88013575

Enterprise Email

partner@chuanglintech.com

Media Cooperation

Marketing@chuanglintech.com

Address

Room 605, Building 6, No.666, Zhenhua Road, Sandun Town, Xihu District, Hangzhou, Zhejiang, China