Corporate Lending

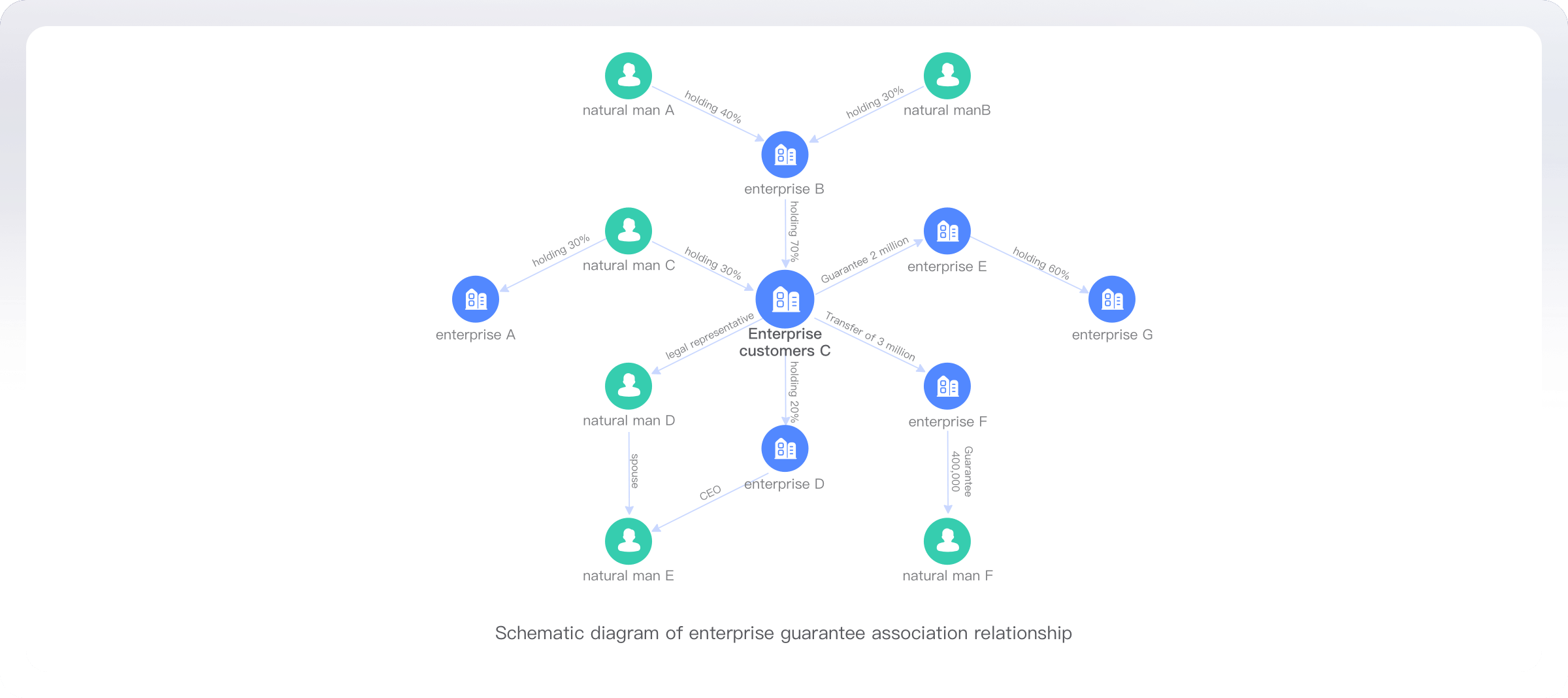

Current challenges in corporate lending include dispersed pre-loan data, high difficulty in business investigations, complex identification of mid-loan enterprise relationship risks, and tracking post-loan fund flows. The business landscape is becoming more integrated, complex, secretive, and trending towards group structures. Enterprises and financial institutions utilize Galaxybase graph database to build a comprehensive customer relationship network, conduct three-dimensional risk assessments, and solve credit dilemmas!

Complex and varied sources of credit investigation data

Complex and varied sources of credit investigation data Poor timeliness in post-loan risk control alerts

Poor timeliness in post-loan risk control alerts

Business Consulting

400-882-6897

Pre-sales Consulting

0571-88013575

Enterprise Email

partner@chuanglintech.com

Media Cooperation

Marketing@chuanglintech.com

Address

Room 605, Building 6, No.666, Zhenhua Road, Sandun Town, Xihu District, Hangzhou, Zhejiang, China