Anti-Fraud

With fraud tactics becoming more covert, widespread, and dynamic, traditional anti-fraud technologies are showing weaknesses such as single dimensionality, low efficiency, limited scope, and poor timeliness. An anti-fraud solution based on Galaxybase graph database enables early identification, prevention, and mitigation of fraudulent activities.

Details of the consulting program

Business Challenges

Difficulty in detecting organized crime

Difficulty in detecting organized crime

Traditional anti-fraud systems primarily operate in a passive defense mode, identifying each transaction in real-time using rules and features but lack the ability to conduct comprehensive correlation analysis from a global perspective, leading to a deficiency in systematic case judgment.

Inability to address the dynamic evolution of fraud

Inability to address the dynamic evolution of fraud

Anti-fraud rules and features are mostly based on past experiences, making it challenging to identify new attack methods or vulnerabilities.

Traditional methods prone to misjudgments and omissions

Traditional methods prone to misjudgments and omissions

Fraudulent groups operate covertly, and traditional anti-fraud methods rely heavily on flagging singular data anomalies, which can detect outliers beyond normal ranges but struggle to uncover fraudulent activities hidden within normal parameters.

Low efficiency and time-consuming manual verifications

Low efficiency and time-consuming manual verifications

Traditional anti-fraud verifications typically involve manual review of application information and telephone verifications, relying excessively on the experience of auditors. Moreover, fragmented data dispersed across various systems leads to time-consuming and costly verification processes.

Solution Introduction

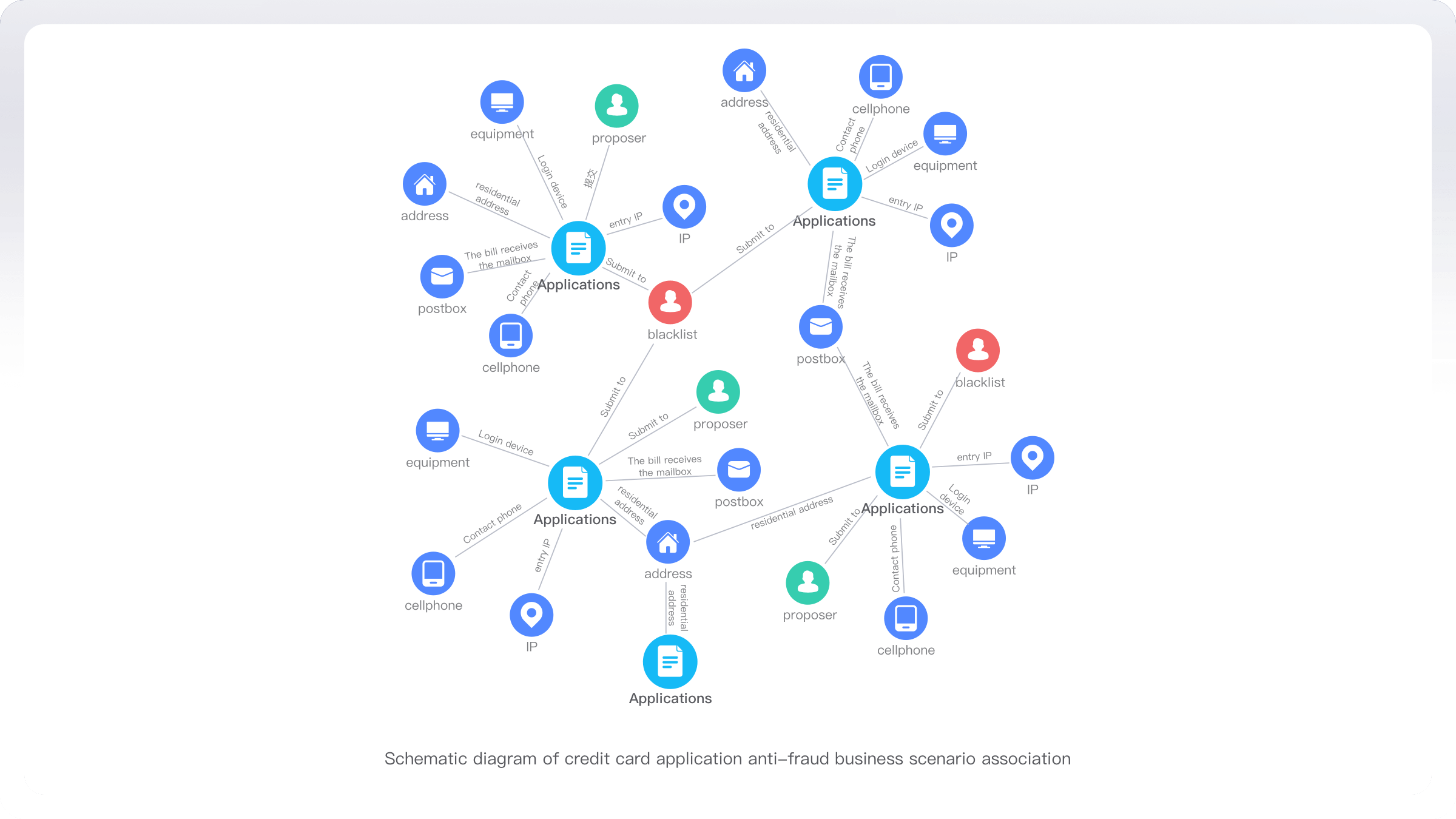

Fraudulent groups aim to cash out large sums and evade legal repercussions, recycling resources with hidden interconnections.

Model Construction

Galaxybase has the capability to integrate diverse datasets, breaking down internal and external bank data into applicants, applications, and related application entities, then constructing a graph model of the application information network.

Fraud Detection

Utilizing clustering algorithms to uncover anomalous associated communities, detecting irregular relationships between entities, automatically identifying risk entities and communities. Using risk propagation algorithms for risk assessment on new applications, effectively uncovering potential fraud risks.

Solution Value

Real-time rik calculations for enhanced anti-fraud efficiency

Galaxybase graph database can compute multi-hop risk indicators in milliseconds, aiding financial institutions in dynamically combating fraud risks and improving operational efficiency and user experience.

Preventing large-scale fraud to mitigate substantial losses

The anti-fraud solution can link various entities in transactional processes, identifying potential fraud risks through deep-link queries, effectively recognizing large-scale, covert fraudulent groups and enhancing detection efficiency.

Application Scenarios

Fraud detection in credit card applications

insurance claims

e-commerce transactions

Create Link is the first domestic commercial graph database supplier with fully independent intellectual property rights, dedicated to providing world-class graph database products and graph intelligence services.

Business Consulting

400-882-6897

Pre-sales Consulting

0571-88013575

Enterprise Email

partner@chuanglintech.com

Media Cooperation

Marketing@chuanglintech.com

Address

Room 605, Building 6, No.666, Zhenhua Road, Sandun Town, Xihu District, Hangzhou, Zhejiang, China